With markets in grim condition the morning of Friday, November 16th, the President held his first meeting with Congressional leaders, who emerged around lunch time with positive comments and a feeling that both sides could work together to address the problem. With the market at its low for the morning, a vigorous rally set in demonstrating a very clear upside reversal, a common indicator of good bottoming action on the indexes. Apple lead the charge with its highest daily trading volume in months and reversed from its morning lows into positive ground for the day. Index volume confirmed Apple’s action and the indexes reversed higher in blistering volume. We call this type of action a “Rally Day,” and while it’s no sure bottom indicator, its action warrants close attention, especially when that Rally Day comes in combination with a distinct 3 waves down pattern.

The current uptrend that started on November 16th is now just a few weeks old. As we can’t be sure how long it will last, we look to the market’s action to dictate to us how much exposure we should be undertaking. In the following sections, we’ll divide analysis into our usual 4 categories we use to assess market health (deemed our 4 Pillars of Market Health). Each pillar discussed below plays a part in evaluating the market’s behavior, but the highest weight needs to be placed on the 1st and 2nd pillars (Indexes and Leading Stocks). Given the market’s size and complexity, having a structured roadmap to evaluate its action is of utmost importance.

Indexes

Our first pillar of market health is the actual day-by-day action of many broad indexes. We look at (in order of importance) the Nasdaq, S&P500, NYSE, and the Dow Jones Industrial Average as our primary gauges of market health. The Nasdaq is the most important index because the young, upstart growth companies in America tend to list their shares on this index, and these companies in turn are the ones that power the U.S. to new levels of innovation and value creation. Similarly, the S&P500 is a broad measure of business activity across 500 of the largest and most reputable companies in America. Both should be watched closely and their individual action should be held above all other indexes.

For the month of November, the Nasdaq rose 1.1% in what developed as a split month. In the first half of the month, the index continued to fall from the heavy selling we observed last month. The day after President Obama won re-election, the index skidded 2.5%. When all seemed hopeless the morning of Friday, November 16th, the market had sold off to early morning depths on worries that the press-manufactured “Fiscal Cliff” would come to fruition. That morning marked the first day lawmakers met after the election to address the gridlock that had previously persisted. Democrats retained control of the Presidency and the Senate, while Republicans still controlled the House.

With gridlock the norm and expectations low, an early morning sell off was reversed by a vigorous rebound after encouraging comments from that first Fiscal Cliff negotiation meeting. The index closed that day at the very top of its range on the highest volume it had seen on a non-options expiration day since May. The index also completed the “3 waves down” pattern we discussed last month. From that point, the Nasdaq spent the final 2 weeks of the month in a clearly defined upward trend with many leading stocks moving to new high ground. The index is currently under accumulation and its action must be met with similar positioning in our own portfolios.

The S&P500 rose 0.3% for the month amid very similar action to the Nasdaq. The index sold off on the same days, bottomed on the same day, completed the same “3 waves down” pattern, and has been in an uptrend since. One key difference between this index and the Nasdaq is that the S&P500 has yet to clear its 2007 bull market peak. Through the end of the month, the index sat 11.3% below this level. In long periods of market compression (i.e. secular bear markets such as that we’re in now), it’s hard for the indexes to make sustainable new highs. While we wait for the compression to complete the near 13 year-long pattern (started March 2000), we recommend caution at these levels.

Overall, as of the end of November 2012, all U.S. indexes are now in a solid upward trend. Given the breadth of accumulation thus far and the aggressiveness of the rebound off the bottom, it wouldn’t be uncommon to see a short 2-4 week pullback before a continued uptrend into the foreseeable future. The indexes will likely meet resistance at key moving averages, the 50 and 200 day simple MA’s, before finally breaking free and powering to new highs. Given the environment, an investor is wise to be positioned long in the market and to maintain discipline given the late stage nature of the overall bull cycle.

Leading Stocks

Our 2nd pillar of market health is to follow the stocks with the best fundamentals in the marketplace. These are the companies providing innovative solutions to drive productivity and serve people across the globe. We at Satellite Capital look for the following fundamentals: large and accelerating quarter-over-quarter earnings and sales growth (preferably 25% QoQ or higher), high returns on equity (preferably 20% or higher), solid 3 and 5 year earnings and sales growth rates (preferably 25% or higher), high levels of cash flow generation relative to yearly earnings, and some product or service that is innovative and is enriching the industry in which the company plays.

As you could imagine, given our preference for the large numbers stated above, the universe of stocks in which we’d want to invest dwindles quickly. It’s rare to find a stock exhibiting all the above criteria to the highest level, but they do exist. For stocks that don’t meet all of the above criteria, which are the majority of all stocks listed on U.S. exchanges, striving to invest in companies that meet as many of the above criteria as possible is key in outperforming averages in a rising bull market.

The month of November started with leading stocks under heavy distribution through November 16th but ended the month on a positive note. As stated earlier, Apple, which is the leading stock in this bull market, experienced a violent correction that took it all the way below its rising 200 day moving average and even below the low of the May-June sell off, which could either give Apple a new market birth or end up being part of a larger topping pattern. We feel even though Apple is long in the tooth from its 2009 lows, the stock likely has room to the upside and holders with big gains could probably sit comfortably for a few more months. The stock has not violated any clear sell rules we use since its move started, and will likely continue to define this bull market through its ultimate top.

While Apple is the stock that must be followed, one stock alone does not ensure solid bull market gains. In combination with Apple, the stocks of other innovative companies should be outperforming and under clear institutional accumulation. These stocks should move to new highs shortly after a new uptrend begins (within the first 4 weeks usually) and display as many of the big fundamentals described above as possible. Many such stocks are making progress over the last few weeks, leading us to believe this rally will likely subsist. We say ‘likely’ because only market action dictates whether it WILL subsist or not, but we need to position ourselves in front of the move to reap optimal gains in the event things play out as expected. If the market turns south, we need to pare our exposure rapidly until safer entries can be made.

In this short 2 week uptrend, stocks that have broken out of their consolidations thus far include (in alphabetical order): ARMH, CVLT, DDD, EBAY, FB, HTZ, QIHU, RAX, RGR, SSYS, THC, & VAL. We give you this list here as a gauge of what is doing well in the market. There are proper buy points for each position and we leave those to you. At present, many of the above stocks are already well extended from their proper buy zones, so an investor is prudent to let these go and instead watch for the next big winner that could and will emerge. A few stocks we are watching closely include (also in alphabetical order): AKAM, CHS, CRM, CTRX, GPS, HCA, ILMN, ISRG, KORS, LNKD, PETM, PNRA, & URI. As before, there are right and wrong places to buy these stocks! Please be careful when examining any stock we follow and be sure to do your own due diligence before investing.

Lastly, I’d like to take some time to discuss a stock most people despise right now: Facebook (NASDAQ: FB). Facebook went public in late May 2012, hit $45.00 per share on its first day of trading, and proceeded to drop to a low of $17.55 just a few months later. That marked a 61% drop from its IPO day high. Many people think this action is very poor and uncommon, when in actuality it’s quite common among some of the big winning stocks of all time. Stocks like Yahoo (1996-2000), Baidu (2005-2007, 2009-2011), and LinkedIn (2011-current) sold off 50-70% from their early IPO highs before settling in and starting very clear and profitable uptrends.

There were 4 key hints to Thomas and I that Facebook had likely bottomed. First, after setting its $17.55 low, FB aggressively set a 30% uptrend followed by the formation of a short and crisp pattern in very quiet volume. This prior uptrend and pattern in quiet volume indicated big institutions were finished selling the stock downward. The second hint was a Barron’s cover in late September that declared Facebook was only worth $15.00 per share. While we enjoy reading Barron’s cover-to-cover weekly, we’ve found that one is generally better off to examine the cover and do the exact opposite. Thus far, that cover has proved to be a good psychological indicator of the investing public’s appetite for this stock. The third hint was the precedent stocks described above (Yahoo, Baidu and LinkedIn). Each of these 3 stocks began trading under high public scrutiny, a recipe for early disaster when hoping to see a stock make big gains. The fourth and final hint we needed was the day approximately 1/3 of the shares in FB’s float came on the market in late October. On this day, everyone expected the stock to nosedive as dejected insiders sold their beaten up shares at ever-falling prices to salvage what value they could. Behind this psychology, we noted that the savvy institutional investor seeking exposure to FB was likely plotting to buy as much as possible at any depressed price level.

Whatever your feelings towards the end product, Facebook is a multi-billion dollar revenue generating machine. With the right business platform in place, it could position itself to generate gobs of money for shareholders. As we expected, institutional players bought in the exact day all insider shares became available, starting the solid uptrend that Facebook currently exhibits. We consider the stock to be an emerging leader and its action must be watched just as closely as that of Apple. Facebook has massive liquidity and the ability to grow its top line at a blistering pace. Definitely keep it on your watch list.

Overall, leading stocks are currently acting very well and moving into new high ground with solid volume behind their moves. Given that market action has turned positive and leading stocks are acting well, seeking some exposure right now is clearly warranted. If this uptrend progresses further, more leaders should emerge in the first 1-2 weeks of December, solidifying the rally’s strength. We encourage you to closely monitor your watch list (that we encouraged you to build in last month’s commentary) and watch for those stocks behaving well to cross acceptable buy points in increased volume. Similarly, when taking a position, it’s crucially important to keep your risk management policies in place and never let a loss get too big. Quickly cutting losses short and letting your winners ride is the path to racking up solid long term stock market profits.

Sentiment & Psychology

Our 3rd pillar of market health is to examine market sentiment and psychology. Understanding market sentiment and investor psychology is secondary in importance behind following the action of the indexes and that of leading stocks. Various gauges of sentiment and psychology are helpful when many indicators are at extremes. When indicators are at moderate levels, less useful information can be gleaned. No one indicator is better than another, and a good analyst will maintain a dashboard of many indicators to help them effectively evaluate the market. At key turning points, many of these indicators will be telling the same story and flashing similar signals (both positive and negative depending on our location within a market cycle).

As of the end of November, almost every gauge we look at is stuck in some sort of middle ground, indicating indecisiveness on the part of institutions. The fear of the press and the investing public right now centers on the “Fiscal Cliff”, a Washington-created concoction of tax increases and spending cuts purported to “push the country into recession.” Your authors feel this sentiment is well overblown and that smart institutions are using this opportunity to accumulate shares of stock at very fair valuation levels. Remember the Facebook psychological phenomenon discussed above and apply it to the broader market: It serves smart institutions well to buy when everyone else rushes to sell. You can acquire shares in great businesses at very fair prices. While the Fiscal Cliff probably won’t be resolved at month’s end, you can be sure institutions will be there snapping up as much stock as they can while the worried public fights to sell their shares.

Finally, I thought it worthwhile to mention 2 indicators that are speaking to us about the state of the market. First, the % of new issues as a total of all stocks listed on the NYSE is still holding at 5-year lows (right at 0.0%). This indicator tells us that little new supply has been injected into the market, meaning demand will eventually have to come from existing companies. This also references the environment, as in how companies feel about the broader economic landscape and their prospects of surviving in public equity markets. The other indicator worth mentioning is the NYSE Advance/Decline line. This line is purely a measure of advancing stocks less declining stocks and works as a measure of breadth in the market. Despite the market selling off sharply from late September to mid-November, this gauge has held near its bull market highs. To us, this indicates selling is not as broad and damaging as it appears, and that stocks at these levels are still well positioned to continue running higher.

History & Precedent

Our 4th and final pillar of market health is examining history and precedence. This is the least important of the other 3 pillars listed above, but can often provide insights into the action of the market that may resemble prior periods of market action. History repeats itself whether we like it or not, and those who forget history are doomed to repeat it.

On the charts that follow, I’m going to examine a precedent period we feel could closely mirror what is currently unfolding in the markets. The period from 1987 to 1989 very closely resembles the action from October 2011 through today. We‘ll demonstrate exactly why we feel this precedent needs to be observed closely, and potential implications if the precedent continues to play out accurately.

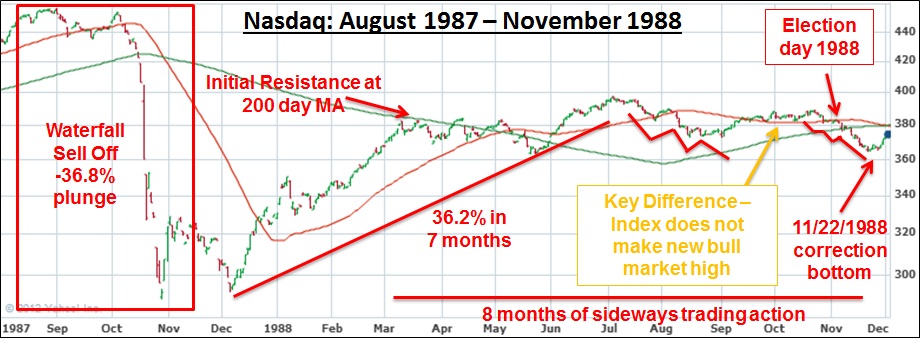

Most investors know that October 1987 brought the sharpest sustained sell off in modern stock market history. In a matter of mere days, the Nasdaq lost 36.8% of its value. On the chart below, you can see that I’ve labeled this sell off as a “waterfall sell off”. This type of sell off is more common than one might think (though none were sharper than the 1987 fall). A waterfall sell off is just as its name implies: a short period of market activity where indexes seemingly go into free fall. After falling sharply in October 1987 and finally settling in December 1987, the index went on a 36.2% tear over the next 7 months.

It’s worth noting that during this rise, the Nasdaq found initial resistance at its falling 200 day moving average before finally bursting to its short-term top in July 1988. From that point, the index traded in a choppy sideways action with 2 clearly defined sell offs, each containing a 3 waves down pattern. 1988 marked a U.S. presidential election year, and you can see from the chart that after George H.W. Bush was declared the winner, the index proceeded to drop into the 3rd and final wave down of its pattern. After this point, the index bottomed on November 22, 1988. From the point where the Nasdaq initially found resistance at its falling 200 day moving average through its final bottom in November, the period of time that elapsed was 8 months. The other key was the twin set of 3 waves down patterns that emerged.

Now let’s compare this to the action we are currently experiencing. On the chart below starting in May 2011, the Nasdaq started in a choppy period followed by a sharp 20.1% waterfall sell off plunge. From the 10/4/11 low, the index went on a 36.3% move over the next 6 months. I find this fascinating because the precedent above was only 0.1% less over a similar time period. From April to June, the index traced a 3 waves down pattern followed by support at its rising 200 day moving average. An extremely choppy 3 month uptrend then began, which created the only major divergence from the precedent above. The Nasdaq today cleared its March peak, whereas the Nasdaq in 1988 was unable to clear its first peak.

From there, the index began another 3 waves down pattern which coincided with the 2012 U.S. presidential election. The election results saw the 3rd and final wave down before the current market low day, set on November 16, 2012. Since that point, we’ve been in a rally that resembles the 1988 precedent. If the precedent continues to play out, it’s quite likely the index will find some sort of resistance at the 50 or 200 day simple moving averages.

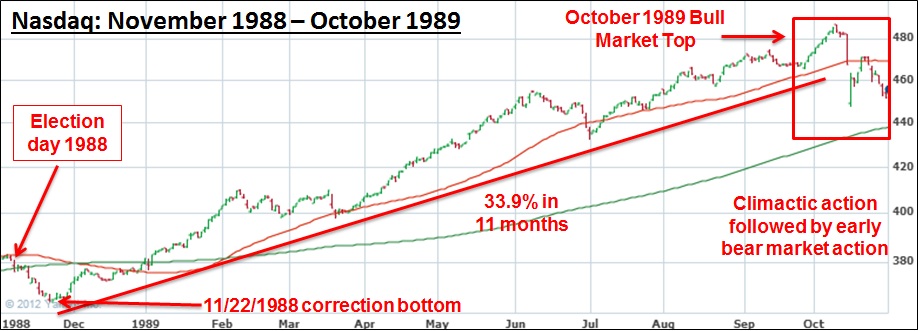

Given how similar the post-waterfall sell off reactions are currently, the chart below extends from the November 1988 bottom to the ultimate October 1989 bull market top. You can see that after 8 months of relatively sideways, choppy action, the Nasdaq went on a 33.9% tear over the next 11 months culminating in the bull market top. We’ve labeled “climactic action” on the chart below, which is a period where the market seemingly goes straight up for no rhyme or reason. During these periods, leading stocks will often advance 25-50% or more. The result of this action was a sharp 1 week reversal, which allowed the 1989-1990 bear market to set in comfortably. During the prior 11 month market advance, many leading stocks had produced gains of 100-200% or more.

To close this section, we can’t be positive that the 1987-1989 precedent will continue to play out accurately. The key to this precedent is the psychology and market action after a waterfall sell off. For other examples of waterfall activity, please look back to October 1929, May 1962, March 1994, October 1997, and May 2010. All we can do is closely observe the market’s action and seek exposure in leading stocks as the market grants us that opportunity. We must position our portfolios according to what the market is telling us; blindly investing in good companies during choppy markets is a recipe for disaster. Right now, market action dictates that we continually increase our exposure and be vigilant about keeping our losses small and letting our winners run. If the precedent does unfold well, you can be sure there will be BIG money to be made and those who are properly positioned in front of the move will have the opportunity to experience life changing gains.

Conclusion

In summary, the market has advanced solidly off its November 16th lows. Many top quality leading stocks are breaking out and moving into new high ground, an encouraging sign that this fledgling uptrend will subsist. It is vital to remember we are in the later stages of the bull market that began in March 2009; with that in mind, our expectations need to be more tempered than if we were in the 1st or 2nd year of a fresh bull market. Over the next month we’ll hear much partisan bickering in Washington about the fiscal cliff and how the problem is ultimately going to be addressed. We need to focus on reading the news less and watching market action very closely. A sign of a quality bull uptrend is when indexes can shrug off bad news and continue higher. Over the past few weeks, this characteristic has become more and more evident. That’s all for this month’s commentary. We wish you an early Merry Christmas and Happy New Year! We will be back with our next commentary in early January 2013.