That precedent had each of the 3 bull market top examples exhibiting a roughly 2 month bottoming/consolidation period before the indexes began their ascents to their final bull market peaks. The Nasdaq has now been going through this action for 2.5 months, in line with the precedent, and looks poised to move higher in the months to come. We always let market action dictate what we do, but the action of the indexes combined with that of liquid, leading stocks hints to us that gains could be in store soon.

While the current uptrend is now 2.5 months old, we can’t be sure how long it will last. We must look to the market’s action to dictate to us how much exposure we should be undertaking. In the following sections, we break our analysis into the 4 categories we use to assess market health (deemed our 4 Pillars of Market Health). Each pillar discussed below plays a part in evaluating the market’s behavior, with the highest weight to be placed on the 1st and 2nd pillars. Given the market’s size and complexity, having a roadmap available to evaluate its action is of utmost importance.

Indexes

Our first pillar of market health is the actual day-by-day action of many broad indexes. We look at (in order of importance) the Nasdaq, S&P500, NYSE, and the Dow Jones Industrial Average as our primary gauges of market health. The Nasdaq is the most important index because the young, upstart growth companies in America tend to list their shares on this index, and these companies in turn are the ones that power the U.S. to new levels of innovation and value creation. Similarly, the S&P500 is a broad measure of business activity across 500 of the largest and most reputable companies in America. Both should be watched closely and their individual action should be held above all other indexes.

For the month of January, the Nasdaq rose 4.1% while the S&P closed the month up 5.0%. The Nasdaq has yet to make a new bull market high and sits 1.7% below its current September 21, 2012 high. Meanwhile, the S&P500 has cleared a new bull market high and now sits 4.9% below its all-time high and 2007 bull market peak of 1576. Round numbers often prove to be springboards in both stocks and on the indexes.

As the S&P500 hangs just below 1500 at 1498.11, the action of the index has been extremely positive. By our count, January closed with the Nasdaq tallying 2 days of professional selling versus 2 days for the S&P500. Such low levels of distribution are encouraging for a continued move higher to start February. 5 to 7 days of heavy selling over a short period (20-25 market days) is a sure way to kill any market uptrend, but until we get there, we need to allocate our portfolios accordingly. A day of professional selling involves an increase in volume day-over-day on an index with a >0.2% decline on the index. While not a perfect indicator, it’s a good gauge to get a feel for net supply/demand coming into the market at any given level.

Overall, index action was much stronger for the S&P500 in January. While the Nasdaq continued to consolidate, the action of market internals suggests the index will soon break free from its holding pattern and make a distinct move. The index action will help dictate how we should proceed in the coming month, but given where everything stands, we assign a high probability to an upside move to start February. Such a move is just what leading stocks need to break free and realize the returns of which they are capable.

Leading Stocks

Our 2nd pillar of market health is to follow the stocks with the best fundamentals in the marketplace. These are the companies providing innovative solutions to drive productivity and serve people across the globe. We at Satellite Capital look for the following fundamentals: large and accelerating quarter-over-quarter earnings and sales growth (preferably 25% QoQ or higher), high returns on equity (preferably 20% or higher), solid 3 and 5 year earnings and sales growth rates (preferably 25% or higher), high levels of cash flow generation relative to yearly earnings, and some product or service that is innovative and is enriching the industry in which the company plays.

As you could imagine, given our preference for the large numbers stated above, the universe of stocks in which we’d want to invest dwindles quickly. It’s rare to find a stock exhibiting all the above criteria to the highest level, but they do exist. For stocks that don’t meet all of the above criteria, which are the majority of all stocks listed on U.S. exchanges, striving to invest in companies that meet as many of the above criteria as possible is key in outperforming averages in a rising bull market.

The month of January brought further breakouts by leading stocks, though most liquid leaders have made only mixed progress. While the indexes made solid progress in January, leading stocks were generally quiet. Most of the gains leading stocks generated in the month came on January 2nd, when the market exploded 3.1% higher on the Fiscal Cliff deal. The quiet action by leaders in January is not all that uncommon; last year very similar action occurred, and the real action by leaders didn’t materialize until February and March. While we are letting the action of the market dictate what we do, the relatively quiet action by leaders was welcome. A true January effect set in, with the most liquid stocks remaining quiet while small caps tended to see better price action. Notable breakouts for the month included (in alphabetical order): AMZN, CELG, EQIX, ISRG, LEN, LL, LNKD, OCN, PCLN, URBN, and VRX.

The biggest story this month was former leader Apple and its action after its earnings announcement on January 23rd. Apple’s quarterly earnings and sales growth rates have been drastically slowing for the last 3 quarters, and it proved to be a downer for the stock in January. Most news articles are stating that Samsung is taking market share from Apple and that Apple’s products have lost their cutting edge appeal.

While we feel the negative sentiment about Apple is actually a positive for the stock, the action of the stock itself dictates that a lot of work needs to be done if Apple were to remotely have a chance at returning to leader status. Apple had a similar sell off between January and July of 2006, but at that time it had rapidly growing earnings and sales. Things are certainly different now, though the corrections are similar. The 2006 correction took Apple 41% off its prior high before the stock regained its footing and exploded higher into the October 2007 bull market top. In the current move, Apple has fallen 38.3% and our view is that we’ve not yet hit the bull market top. Given this fact, we feel the stock will likely continue higher at some point, but feelings alone do not garner our investment dollars. Market action is what garners investment decisions. Apple must prove itself before any investment is warranted.

One interesting note is that despite Apple plunging 12.4% on its earnings announcement, other leading stocks were largely up that day, as investment dollars flowed from the former leader into stocks that could power the next leg of an uptrend. AMZN, EBAY, FB, LNKD and other stocks showed strength on AAPL’s weakness.

Overall, the true leaders have likely broken out and moved by this point, so your watch list is likely as small as ours. At this stage of the game, it comes down to position management and weeding your portfolio to maximize the efficacy of dollars invested by identifying your best performing positions. The optimal way to start a rally is casting a wide net and then pruning back as market action dictates further investment. Most leaders appear to be fairly early in their move, and several have recently tested their 10 week moving averages (successfully), which is usually a sign of pause before continuing higher. We need to remain alert to any emerging changes and resist complacency about the progress realized since the November 16th low.

Sentiment & Psychology

Our 3rd pillar of market health is to examine market sentiment and psychology. Understanding market sentiment and investor psychology is secondary in importance behind following the action of the indexes and that of leading stocks. Various gauges of sentiment and psychology are helpful when many indicators are at extremes. When indicators are at moderate levels, less useful information can be gleaned. No one indicator is better than another, and a good analyst will maintain a dashboard of many indicators to help them effectively evaluate the market. At key turning points, many of these indicators will be telling the same story and flashing similar signals (both positive and negative depending on our location within a market cycle).

This month we’re going to examine an indicator known as Dow Theory. Charles Dow noticed in the late 1800’s that a broad index of industrial stocks and a broad index of transportation stocks should move together. If the indexes didn’t move together, the divergence was a key signal that investors were expecting something wrong with the economy. As industrial production ramps up, higher profits are expected, and as transportation companies will be needed to move the goods, this leads to higher profits for shippers as well. If higher profits are expected, a rise in one market should also mark a rise in another index.

Given his observations, astute observers today still watch the action of the Dow Jones Industrial Average versus that of the Dow Jones Transportation Average. Prior to January 2013, the Transports were showing a major divergence from the Dow Industrials. The Transport average hit its bull market high in July 2011 and until recently was unable to clear that level. Meanwhile, the Dow Industrials hit a new bull market high in May 2012, September 2012, and now again as of January 2013. These indexes held in a state of divergence (one was making new bull market highs while the other was unable to do so) for almost 18 straight months.

Last month this all changed, as the Industrials made new bull market highs (and sit just 2.4% below their October 2007 all-time highs of 14198) and the Transports made both new bull market highs (since the March 2009 market bottom) AND a new all-time high, taking out its May 2008 peak of 5550 and reclaiming its July 2011 peak of 5654. Now that both Industrials and Transports have confirmed each other, the state of divergence is gone and the markets can clearly be read as continuing the bull market that started in March 2009.

In January, the NYSE Advance/Decline line continued its trend to new high ground, consistent with the action of the broader market. The A/D line often acts like a magnet, both pulling the market higher as it makes new highs, and lower as it makes new lows. January proved to be no exception, as the line was already well into new high ground before the market confirmed its action later in the month. Similarly, the number of stocks making new highs has greatly outpaced those making new lows since the 11/16/12 bottoming day. This is important because holding stocks while many are making new highs is a sure fire way to put yourself in the right position to generate returns. It’s nearly impossible to swim against the stream in the market and positioning a portfolio accordingly is the key to achieving outsized performance.

Finally, it’s worth pointing out that market sentiment is reaching extreme levels. There is bullishness running rampant in the market and it can be seen everywhere. Investors Intelligence has the last Bulls versus Bears reading at 54.3% for the bulls and only 22.3% for the bears. Similarly, AAII has its survey reading 48.0% for the bulls and 24.3% for the bears. As of Friday, 85.14% of NYSE stocks are trading above their 200 day moving averages (85-90% has been a long-term cap on this measure).

Dozens of other indicators are flashing similar signals. At this point in the rally, the positive market tone could move back to healthy levels either via a sell off or a prolonged period of market inactivity. Both prove to frustrate investors, and healthy frustration is just what might be needed to help power things higher. Despite the extremes, our job is to hold our positions until the facts change and dictate to us otherwise. Sentiment can remain at extremes for long periods of time. As market operators, we must be cognizant that we’re in dangerous territory but stick to our guns, as periods like this can go on for weeks or even months.

History & Precedent

Our 4th and final pillar of market health is examining history and precedence. This is the least important of the other 3 pillars listed above, but can often provide insights into the action of the market that may resemble prior periods of market action. History repeats itself whether we like it or not, and those who forget history are doomed to repeat it.

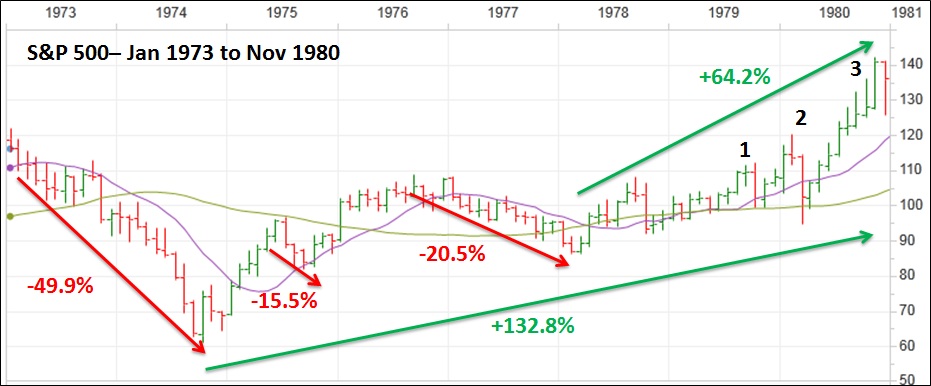

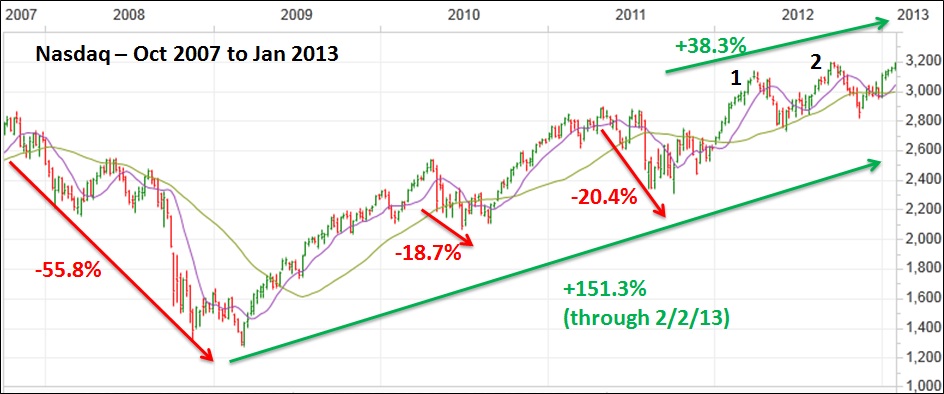

On the charts that follow, we’ll re-examine the S&P500 1973-1980 bear/bull market cycle, as compared with the current Nasdaq from 2007 through today. You may remember I previously examined this period in our September 2012 commentary. Below you will find a chart of each period, as well as a table comparing the returns throughout each move. Remember the point of our analysis here is that “history doesn’t exactly repeat itself, but it often rhymes”. By understanding what has happened in the past, we are better able to use psychology and precedent to gain insight to what we may be experiencing at present.

Examining the first chart, there are a few noteworthy items. Starting on the left, the broader markets went through a correction of 49.9%. After bottoming in October 1974, the index started its way higher and experienced one short correction of 15.5%. After continuing higher, the S&P then went into a 20.5% correction before starting the final run to its bull market top in November 1980. The complete last leg up measured after the 20.5% correction total 64.2%. The full bull market returned 132.8% to investors.

The current chart has very similar characteristics. After a 55.8% sell off, the market bottomed in March 2009. 14 months later, the index experienced an intermediate term correction of 18.7%, and then continued higher into an intermediate top. Over the next 5 months, the Nasdaq lost 20.4% (within 0.1% of the similar correction on the S&P chart from 1973-1980). From that point, the Nasdaq has been in a solid uptrend pushing 38.3% higher. If the Nasdaq were to duplicate its S&P precedent, a 64% move up from 2298 would take the index to a bull market high of 3773. Since the March 2009 low, the index has powered 151.3% higher.

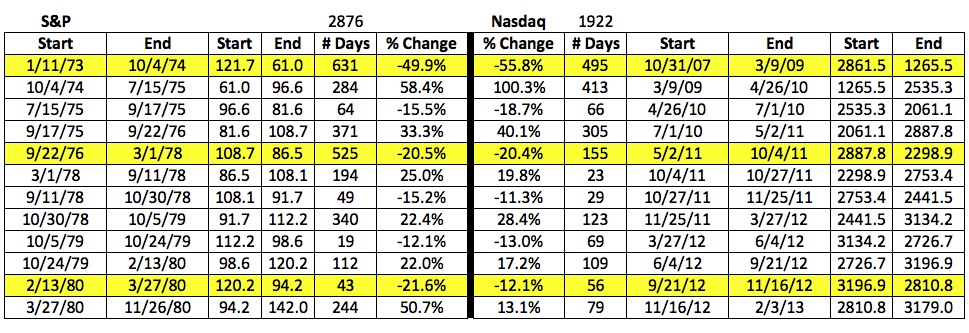

On the table above, we align the uptrends and the downtrends from the 2 periods being examined, noting both the number of days in the move and the percentage changes in the prices of the indexes. The last row compares the final leg up of the 1974-1980 bull market versus what we feel could be the last leg up of the bull market that began in 2009. On the table, I’ve highlighted 3 rows that I’d now like to discuss briefly to help you understand why this precedent is powerful.

The first highlighted line compares the 2 bear markets: 1973-1974 and 2007-2009. The magnitude of the corrections proves to be eerily similar. If you wanted to get much deeper into the analysis of these bear markets, you could also compare 1872-73, 1906-07, and 1937-38. Each bear market was about 34 years apart and all took the indexes 50-60% lower. There are definite generational tones to these types of corrections and I’ll examine these occurrences in future market commentaries.

After the bear markets ended, the indexes began an ascent over the next couple of years. After a solid move up followed by an intermediate correction and one final push higher, the indexes went into a protracted longer correction. This is the 2nd highlighted row on the table above. While the 1976 correction lasted 3x longer than the 2011 correction, the depths of the 2 are remarkably similar: -20.5% versus -20.4%. Also, closely examine the periods after these corrections. History doesn’t exactly repeat itself, but it often rhymes.

Finally, the 3rd highlighted row is a key difference that I need to take some time to explain. You may recall that between January and March of 1980, 2 brothers tried to corner the silver market, causing market panic across all asset classes. The action by the Hunt boys led to the exchanges rapidly raising margin requirements to stymie rampant speculation, and to burst the bubble that was appearing. The action culminated on March 27, 1980, which was the exact bottom of the sell-off that lead to the 8 month run into the final bull market top in November 1980 (see the December 2012 commentary for further discussion of this precedent). I have left the chart from last month below for you to see the damage that was done and the resulting market action.

The magnitude of the February-March 1980 correction was obviously much greater than that from September-November 2012. I wanted to highlight this fact given that circumstances will always be different, and different shocks will be interpreted in different ways by the market. The overall pattern of zigs and zags still lines up perfectly despite this minor difference. In the final phase of bull markets, hysteria usually presides, as everyone dives into the market at the same time, scrambling to not miss the boat. Some of the most powerful and life changing gains that the great investors have made have come during the final leg up of a bull market.

To close this section, we can’t be positive if the precedent described above will continue to play out. All we can do is closely observe the market’s action and take exposure in leading stocks as the market grants us that opportunity. We must position our portfolios according to what the market is telling us. Right now, market action dictates that we continually increase our exposure and be vigilant about keeping our losses small and letting our winners run. If the precedent does play out, you can be sure there will be BIG money to be made in 2013 (and possibly into 2014?), and those who are in front of it will have the opportunity to experience life changing gains.

Conclusion

In summary, while we’ve had a divergence in the 2 leading indexes (Nasdaq versus S&P500,) and leading stocks have largely held tight just above breakout prices, overall gains have yet to be spectacular. A bull market requires a breadth of leaders to power it higher, and the current breadth indicates that a powerful move could be coming. Many companies from diverse industries have broken to new highs and are holding in fairly tight ranges. This indicates a lack of selling by institutional investors and is further proof that the market could continue higher in coming months.

Given all we’ve examined above, the uptrend continues and the only thing for us to do is to position our portfolios to take advantage of the opportunities that are before us. When the facts change, our allocations will need to change. Until then, keep your positions on a tight leash. To quote Jesse Livermore: “It’s never the thinking that makes you money in the market; it’s the sitting and waiting.” The investor who can both buy right and sit tight is an uncommon breed. We hope you have a great February and we’ll be back with another commentary in early March!