Indexes

The first pillar of market health is observing the actual day-to-day action of broad indexes. We examine (in order of importance) the Nasdaq, S&P500, NYSE, and the Dow Jones Industrial Average as our primary gauges of market health. The Nasdaq is most important because the young, upstart growth companies in America tend to list their shares on this index, and these companies in turn are the ones that power the U.S. to new levels of innovation and value creation. Similarly, the S&P500 is a broad measure of business activity across 500 of the largest and most reputable companies in America. Both should be watched closely and their individual action held above other indexes.

The Nasdaq rose 1.6% for the month of September, marking the 4th straight month of price gains and a 17.2% rise from the June 4, 2012 correction low (from 2726.68 to 3196.93). Over the rally that originated on 10/4/2011, the Nasdaq is up 35.6% and currently holding near fresh bull market highs. Similarly, the S&P rose 2.4% for the month, also marking the 4th straight month of price gains and taking the index to a fresh bull market high. The index is up 35.9% since the 10/4/11 low and up 15.3% from the June 4, 2012 correction low.

Examining recent market action is helpful to get a flavor for the current trend of the market. At the bottom of the vicious bear market that was October 2007 through March 2009, commonly known as the “Great Recession”, a fresh bull market originated which continues through this day. On the Nasdaq chart below, I’ve added three lines representing key support levels for this 3.5 year-old bull market. It’s useful to note that solid corrections (greater than 15%) set in after each break of one of these lines. The same is true of every bull market in history. This analysis is the simplest measure of general market trend and can be performed by anyone looking to protect themselves when the bears start to attack. The bottom of the three below lines represents the current support level for the Nasdaq index. When this line is broken by adverse price action, a defensive position must be taken.

Proper trend line analysis is best performed on a weekly chart to reveal true market support and resistance levels. The above monthly chart is presented to demonstrate to the reader the long-term nature of how trends persist until something as simple as a trend line break signals a transition. Bull and bear markets alike typically move in 3 solid waves in the primary direction (3 up for bull markets and 3 down for bear markets) and 2 countertrend moves (2 down for bull markets and 2 up for bear markets). This is not to say markets will always unfold in an exact manner, but history tends to repeat itself in both life and the stock market. On the chart above, you can clearly see we would now be in the 3rd and likely final phase up of the bull market that started in March 2009. This writer has examined every bull and bear market in the history of U.S. exchanges and the action and repeatability over time is astoundingly similar.

Overall, the end of September 2012 finds all U.S. indexes in solid bull uptrends until market action dictates otherwise (i.e. watch for possible trend line breaks). Again we are ideally long in bull markets and in cash or short in bear markets; the best defense in the market is then being flexible with interpretation and moving into or out of the market as indicators transition between bullish and bearish.

Leading Stocks

The 2nd pillar of market health is to follow stocks with the best fundamentals in the marketplace. These are the companies that provide innovative solutions to drive productivity and serve large amounts of people. At Satellite Capital we look for the following fundamentals: large and accelerating quarter-over-quarter earnings and sales growth (preferably 25% QoQ or higher), high returns on equity (preferably 15% or higher), solid 3 and 5-year growth rates (preferably 25% or higher), high levels of cash flow generation relative to yearly earnings, and some product or service that is innovative and is enriching the industry in which the company plays.

As you could imagine, given our preference for the large numbers stated above, the universe of stocks we’d want to invest in gets whittled down fairly quickly. Stocks displaying all of the above criteria to the highest level are rare, but they do exist. As the majority of all stocks listed on U.S. exchanges fail to meet all of the above criteria, restricting our investments to companies that pass our screens handily is key to outperforming averages in a rising bull market.

As of the end of September 2012, one stock has eclipsed all others as the stock to own over this bull market, and that stock is Apple (NASDAQ: AAPL). Apple has consistently met all of the above listed criteria until last quarter, when earnings dipped from +92% quarter-over-quarter (on a year-over-year basis) to +20%, which is still remarkable considering the company’s market cap at just over $610B. Apple has been on a tear from the bear market bottom in March 2009, returning an impressive 635% from its low of $78 set in January 2009. That works out to an amazing 76% compound annual growth rate (CAGR)! New stocks emerge every bull market that exhibit the kind of returns Apple has. They all display similar characteristics before they start runs similar to the one Apple is experiencing, and learning to identify such stocks early in their moves is key to making huge profits in bull markets. Our opinion is that Apple is still going strong and will likely continue powering itself and the rest of the market to new highs in coming months.

Other current leading stocks come from a broad range of industries (home building, technology, retail, and pharma), which is a good indication that the market is healthy and resoundingly in a bull uptrend. Stocks warranting examination across different industries are LEN, NSM, LNKD, RAX, STX, GOOG, KORS, ALXN, and CTRX. I caution against blindly investing in these stocks (there are right and wrong times to correctly enter and exit them), but rather use this broad list as a means to evaluate how the most fundamentally sound companies are achieving superior stock returns in the public marketplace. Such recent performance reinforces our overall analysis that this bull uptrend will persist.

Sentiment & Psychology

The 3rd pillar of market health is examining market sentiment and investor psychology. Understanding market sentiment and investor psychology is secondary in importance behind following the action of the indexes and that of the leading stocks, as looking at various gauges of sentiment and psychology are helpful when many indicators are at extremes. When indicators are at moderate levels, less useful information can be gleaned. In this analysis, I will comment on 5 indicators we follow at Satellite Capital. No one indicator is better than another, and a good analyst will keep a dashboard of many indicators to help them effectively evaluate the market. At key turning points, many of these indicators will be telling the same story and flashing similar signals. Here we go:

NYSE Short Interest ratio – This indicator measures short interest, which is an indication of the number of shares that have been sold short on the NYSE exchange. When an investor sells short, he or she is expecting the price of a particular security to decline, and to thereby profit on the price of that security falling. Measuring short interest is important because it gives you a good indication of where investors are putting their money to work. This is usually a solid contrarian indicator because the market serves to fool the greatest number of people. At almost every major market top, short sales have been at extreme lows as investors expect higher and higher prices. Currently, this indicator started the month at 5-year highs and backed off a little as the month went on. From a pure contrarian standpoint, those short sellers will eventually have to buy back the shares they sold in the market, which would prove for a massive burst of buying activity and a potentially very large rally in the market. History shows that the majority of short sellers are wrong on the key timing in the market.

Investor’s Intelligence Bulls vs. Bears survey – This indicator looks at investment writers in the marketplace and records whether they are bullish, bearish, or mixed. As with the other indicators being examined, it’s not important to know that 40% of authors are bullish, 30% bearish, and 30% mixed; the key is when these percentages are taken to extremes. Crowd psychology pushes everyone to be bullish at the point when they should be bearish, and vice versa. At the beginning of September 2012, bullishness was running above 50%, a fairly good indication that writers were getting overly bullish about recent market action. In the last few weeks of the month, this percentage dropped back into the 40’s and is at a level that could allow the uptrend to solidly continue.

Number of stock splits in the last 30 days – This indicator looks purely at the number of companies that are splitting their shares as a gauge of how companies feel about the valuations of their stocks. There have been 40 splits in the last 30 days, which is approaching the 5-year high. The 5-year high for this indicator was set in January 2008 at 70. When companies feel their stock looks expensive, they will often split shares to bring down the price, even though doing so has no economic value add to the company (Warren Buffett’s Berkshire Hathaway (NYSE: BRKA) has never split its shares for this very reason).

New issues on NYSE in last 1 year as % of all NYSE stocks – This indicator takes the number of new issues on the NYSE in the last 12 months divided by the total number of stocks listed on the NYSE. A high level ratio (say 1.0%) indicates that companies want to go public in order to capture large valuations in the marketplace. In December 2007, this indicator measured 0.9%, which is the current 5-year high. Today, the indicator measures 0.0%, which tells us that companies are uncertain regarding the current economic environment and are not willing to go public to risk the valuation of their company in the public marketplace.

Price-to-Book of Dow Jones Industrial Average – This indicator measures how much investors are willing to pay for shares relative to the book value (i.e. Shareholder’s Equity) of firms listed on the Dow Jones Industrial Average (30 total stocks). The 5-year high for this indicator was set in October 2007 when the measure was 4.42x. Today, this measure is at 3.62x, which is approaching extremes but has not yet surpassed the 5-year high.

In conclusion, the 5 indicators discussed above are a bit mixed, an indication that we’re not far enough into extreme levels to give conclusive evidence on either the bull side or the bear side. Given we are currently 3.5 years into the bull market that started in March 2009, and with little current evidence offered to the negative side, we remain long until more indicators approach extreme levels. Bull and bear markets alike do not start in a day or a week and certainly do not end in such a time frame. The indicators above will serve as strong signals to steer us one direction or another when the correct time comes; until then, we remain cautiously bullish and adhere to the currently upward trending market.

History & Precedent

The 4th and final pillar of market health is examining history and precedence. This is the least important of the other pillars listed above, but can often yield insights into market action derived from resemblance to prior periods of market action. For example, every 32-36 years the same style of bear market happens.

For those of us that remember the crazy market action of 2007-2009, one may be surprised to know that this bear market wasn’t the first of its kind. The circumstances are different in most bears, but the action of the market is fairly similar. In future write-ups, I will examine the 2007-2009 bear market versus the 1973-1974 bear, versus the 1937-1938 bear, versus the 1906-1907 bear, versus the 1872-1873 bear. The key insight is that if you looked at a weekly chart of any major index during these bear markets, you would be looking at the same chart duplicated 5 times, just spaced a little over 30 years apart. Stock market action and history are funny things; history repeats itself whether we like it or not. Those who forget history (and historical market action) are certainly doomed to repeat it, as George Santayana once observed.

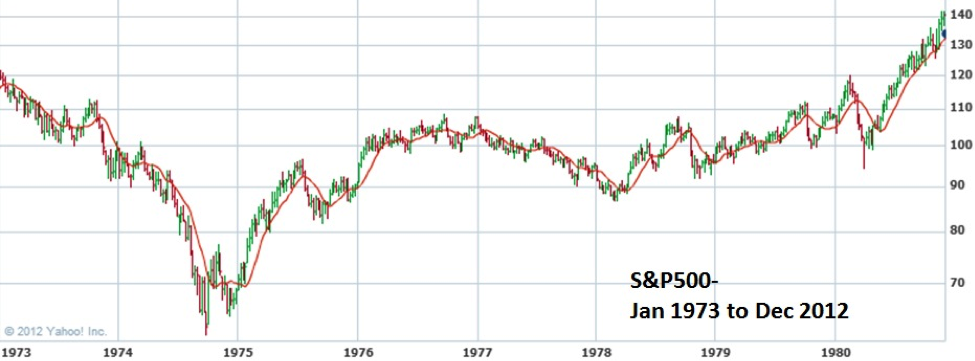

Examining the current market action and finding a period in history that looks similar isn’t all that difficult. Comparing a chart of the S&P500 from 1973 to 1980 versus the same chart of the S&P500 from 2007 to today yields remarkable similarity. From the top of the nasty bear market that began in January 1973 to the bear market trough in October 1974, the S&P500 declined from 121.74 to 60.96, a 49.9% decline over 22 months.

From the October 1974 low to the final bull market high in November 1980, the S&P500 rose 132.8% from 60.96 to 141.96 in 72 months. This bull market high cleared the 1973 high of 121.74 by 16.6%.

Similarly, from October 2007 to March 2009 (18 months), the S&P500 fell from 1576 to 666 (-57.7%). Thus far in the bull market that followed the “Great Recession”, the S&P500 has risen 119.2% from 666 to 1474, which is below the October 2007 peak of 1576 by 6.9%. If the 1974-1980 precedent were to hold exactly (which I assure you it won’t), that would imply that the index would rise 16.6% above 1576 to 1837, which is 25.8% above Friday’s closing price. So similar market action could indicate lots of room to run yet in this bull market. The most important psychological precedent would be for the S&P500 would be to clear the 1576 high from October 2007. Level is more important than price action when examining the psychology behind precedent.

An interesting point to note is that Ronald Reagan was elected in November 1980, the very month the 1974-1980 bull market hit its apex. 20 years later George W. Bush was elected 8 months after the cyclical bull market of 1982-2000 had ended, and would then endure a 2 year bear market at the start of his presidency. Reagan assumed office on promises of free market principles, and eventually proved that his policies were strongly beneficial for the economy. As many investors anticipated the eventual positive results, the market fooled the masses and proceeded to go into a bear market from November 1980 until August 1982, when many of Reagan’s policies began to take effect. Politics aside, the salient point is that the market again served to fool the greatest number of people. Regardless of whether President Obama or Governor Romney wins in November, you can be sure the market will still realize its goal of fooling the most people. To initiate the next long-term bull market though, the U.S. will first need to weather a bear market, accompanied by policy changes enabling us to escape current problems and lead innovation and growth forward.

Conclusion

In summary, until market action indicates otherwise, we remain solidly in a bull market and entirely focused on the long side of the market. The actions of indexes and leading stocks are currently pointing to continued upward movement. Remember that market analysis is rarely black and white, and rather almost always various shades of grey. Learning to interpret market action and to be fluid with your interpretation as facts change is the key to success in the market. We hope you have a great October and we’ll be back in early November with an analysis of October’s action.